We Begin With You

Perhaps you have just experienced the loss of a loved one and are now in a new role as Trustee. You may be feeling overwhelmed and thinking one or more of the following:

I don’t have time to deal with the record-keeping and accounting properly.

It’s worth it to me to pay a neutral third party to take some of the Trust Accounting responsibility off of my shoulders so that I can deal with other personal or trust & estate-related issues.

There are a number of beneficiaries involved and I want them to feel that I am serving them with transparency and a modicum of oversight.

I’m in over my head on the accounting.

I waited too long to get started and now it seems impossible to get the accounting done on time.

Your Personalized Path Forward

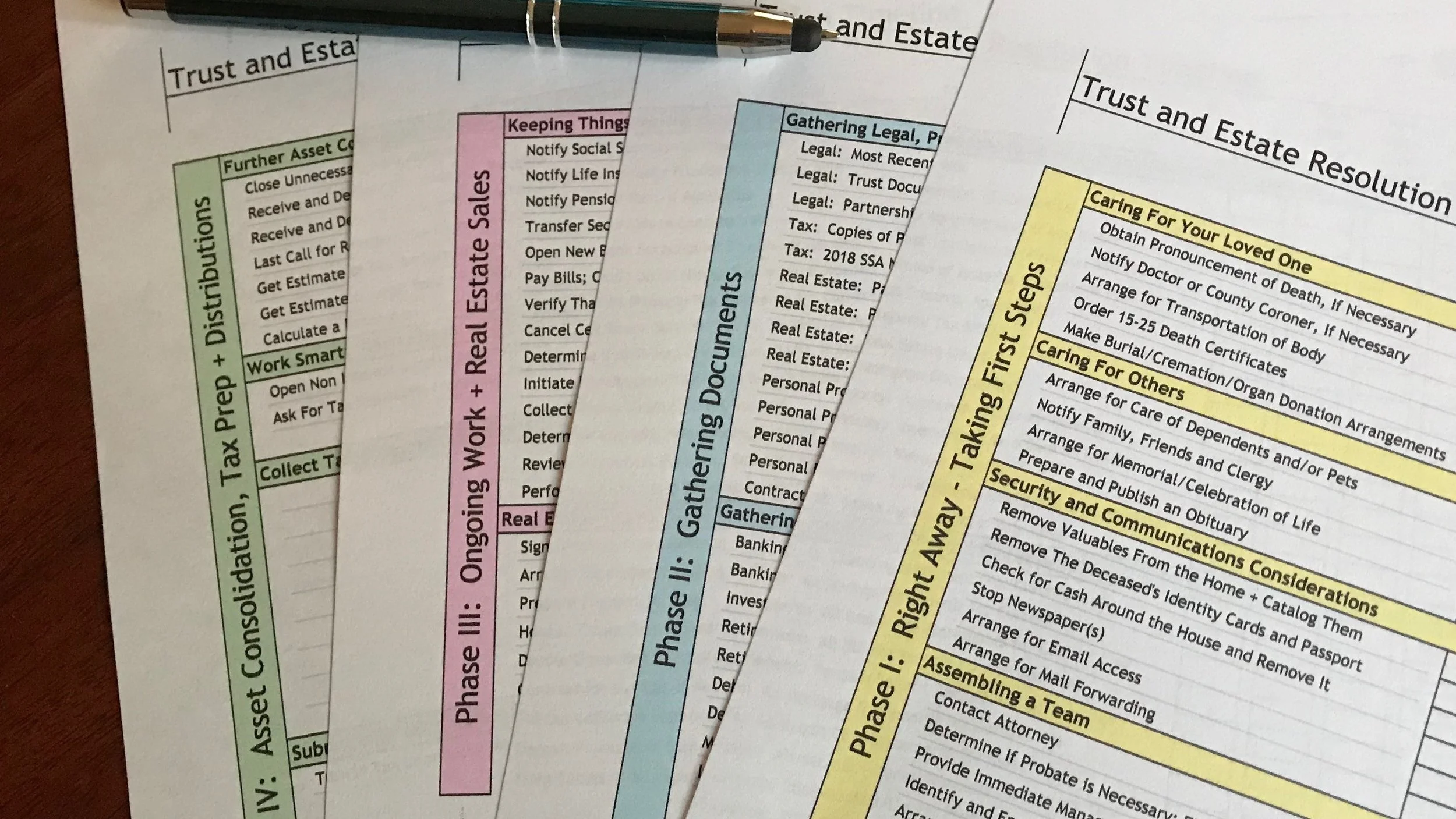

After an initial consultation, we will devise a step-by-step prioritized path forward tailored for your individual circumstance.

I’ll give you a specific list of statements, receipts and documents that I need to make a start, and I will follow up with questions as they arise.

I am available for in-person meetings with you. That said, it is not uncommon for me to work remotely, sharing documents electronically as needed and receiving updates via telephone call or email.

Your personalized plan will depend upon your specific situation and where you are in your Trust or Estate Administration process when we begin work together.